Welcome to Onerise, a leading fund manager dedicated to unlocking the potential of alternative investments in private credit and real estate. Our mission is to provide our investors with unique access to opportunities that are poised not only for attractive returns but also for significant capital growth.

At Onerise, we believe in the power of diversification and the strength of alternative investments. Our focus is on carefully curated real estate and private credit investments, where we have honed our expertise to deliver exceptional results. Our investments are meticulously selected to meet our high standards of profitability and growth potential.

We stand out in the industry for our commitment to excellence and our comprehensive approach. Our team of seasoned professionals brings a wealth of experience in financial markets, real estate, and credit management. This expertise allows us to identify and capitalize on opportunities that might otherwise be overlooked, providing our investors with a competitive edge.

Our investment approach allows us to strategically allocate resources across a diverse range of mortgages and direct property investments. This structure enables all our investors to benefit from a broad spectrum of opportunities, ensuring a balanced portfolio that is designed to maximize returns while minimizing risk. By focusing on both mortgage and direct property investments with income and growth potential, we offer a robust and resilient investment strategy.

At Onerise, we’re more than just a fund manager; we’re your partner in navigating the complex landscape of alternative investments. Our goal is to build lasting relationships with our investors, grounded in trust, performance, and a shared vision for success. Join us on this journey to redefine investing and achieve unparalleled growth and returns.

Download the PDS and TMD.

Mortgage Investments

Investments that provide income and security by investing in a portfolio of mortgages that are secured against residential and commercial property.

| Investment Category | Mortgages |

| Fund type | Open-ended |

| Suitable for | Individuals, Companies, Trusts & SMSFs |

| Investment targets | Mortgage loans over residential & commercial property. |

| Target Return | 6.5% - 9.5% |

| Recommended Term | 12 - 18 months |

| Invest From | $1,500 |

| Income | Yes |

| Capital Growth | No |

| Investment Structure | Unit Trust |

Direct Property Investments

Investments that deliver consistent income and the potential for capital growth by investing in a diverse portfolio of commercial properties.

| Investment Category | Direct Property |

| Fund type | Open-ended |

| Suitable for | Individuals, Companies, Trusts & SMSFs |

| Investment targets | Commercial properties with strong growth potential. |

| Target Return | 6.5% - 8.5% |

| Recommended Term | 18 - 36 months |

| Invest From | $1,500 |

| Income | Yes |

| Capital Growth | Yes |

| Investment Structure | Unit Trust |

Benefits of Investing with Onerise

Download the PDS and TMD, then complete the application form to invest.

Pooled funds that invest on behalf of our investors into a portfolio of qualifying mortgage loans and direct property assets.

Receive consistent returns through regular income distributions

Benefit from the stability of investing in tangible assets.

Invest in a portfolio secured by high-quality real estate properties.

Enjoy the full value of your investment with no hidden fees

Spread your risk with a diversified mix of mortgages and properties.

A disciplined investment process with careful asset selection.

Stay informed with clear and detailed reporting on your investments.

Easily monitor and manage your investments online at any time. (coming soon)

How it Works & Investment Strategy

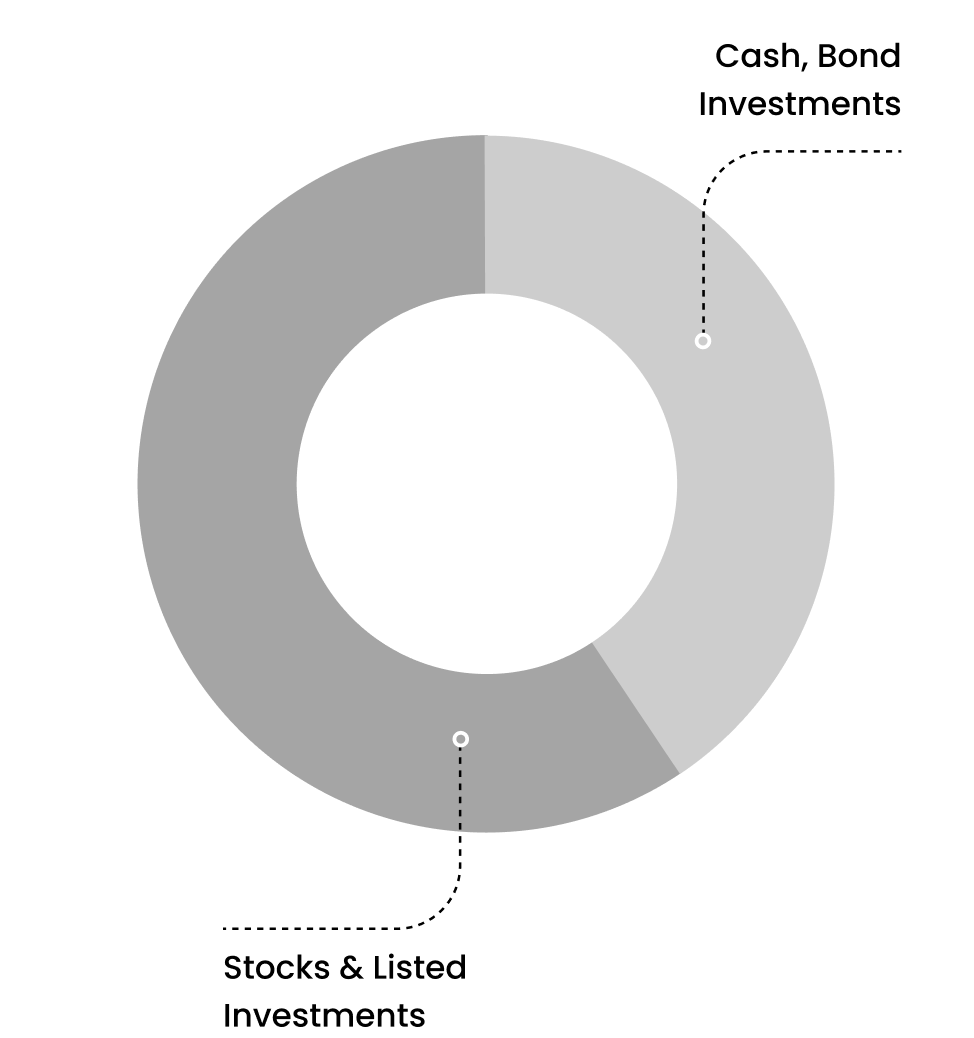

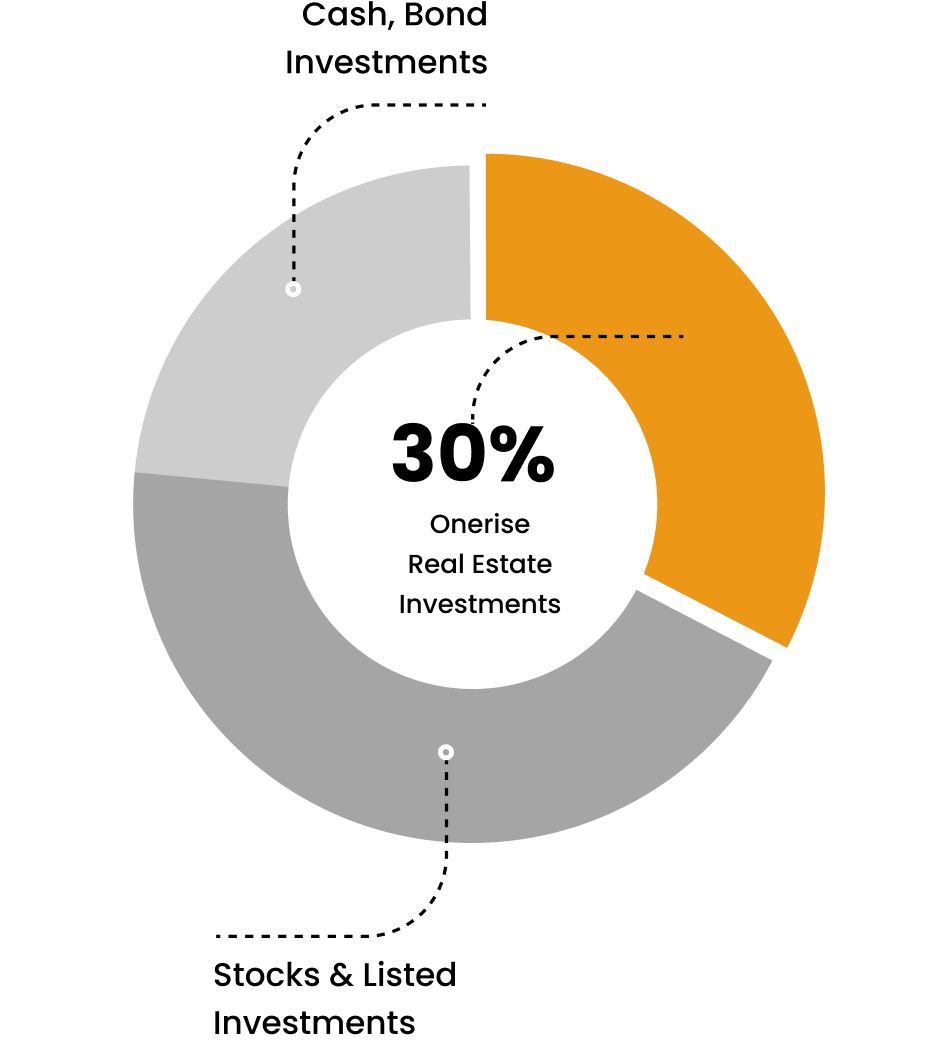

An enhanced investment portfolio should consist of approximately 30% invested in real estate backed investments to generate a mix of stable income and growth.

Traditional Investing

Traditional investment portfolio that is usually restricted to cash, bonds and stocks.

Enhanced Investing

An enhanced portfolio which includes private real estate investments.

With Onerise you’ll be able to participate in investments, that were traditionally only accessible by wealthy and institutional investors, regardless of your financial position or net worth.

How it Works & Investment Strategy

Investment

We source high-quality and experienced borrowers for our mortgage funds and attractive properties for direct property funds through our network of partners. We take a hghly disciplined and detailed approach plus scrutinise every transaction, selecting only those that fit our rigorous risk-return models.

MORTGAGES

We specialise in mortgage investments for seasoned borrowers, offering returns that exceed the market average.

DIRECT PROPERTIES

Our strategy is to invest in properties located in good locations, acquiring them below market value to maximize overall returns.

Manage

We conduct intensive management of all our investments in order to create and maximise value. The rigourous research undertaken prior to an investment allows us to identify the most appropriate transactions that meet our investment criteria.

MORTGAGES

Every loan and borrower are subject to ongoing reporting and compliance requirements to ensure full compliance with the loan conditions.

DIRECT PROPERTIES

We reposition and improve our property investments to maximise income and create capital growth.

Exit

A straightforward investment exit is typically facilitated by the efforts made during the investment and management phases. However, the exit process is carefully managed, offering investors options for repayment and/or reinvestment.

MORTGAGES

Borrowers repay the mortgage loans, with final income payments and principal capital returned to investors or reinvested.

DIRECT PROPERTIES

Direct Property investments are either sold with final income and any capital growth distributed to investors and/or reinvested.

Choose an Investment

With Onerise you have the choice of participating in either a single investment or to create a portfolio consisting of multiple investments. To learn more about our investments or to start investing, select from the options below.

Onerise Investment Fund (OIF)