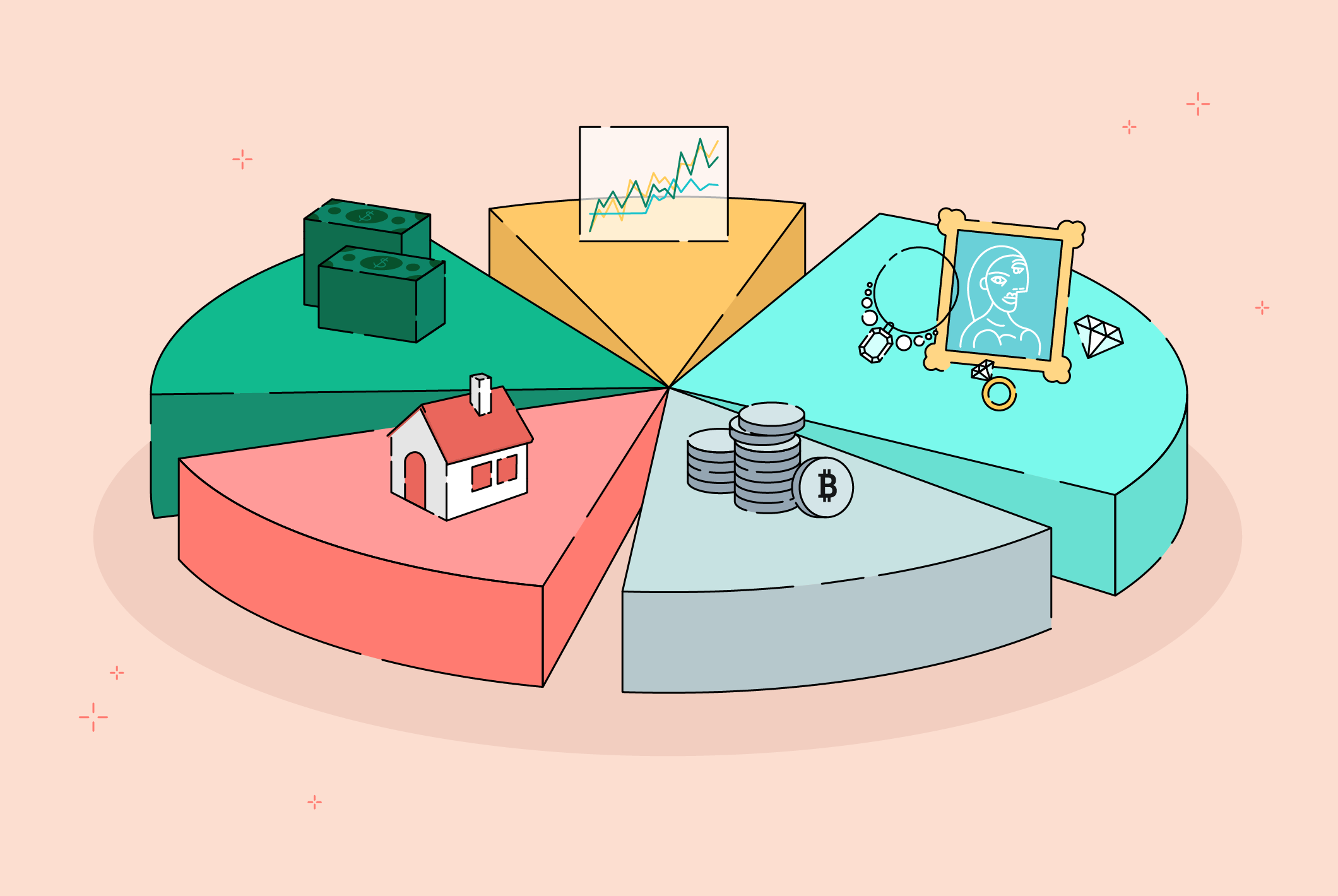

Diversification is a key principle of successful investing, and Australian property funds offer an excellent avenue for investors looking to broaden their portfolios. By combining mortgages and commercial property investments, these funds provide a balanced approach to risk and return.

Australian property funds typically invest in a mix of mortgage-backed securities and direct commercial property holdings. This dual approach allows investors to benefit from the stability of mortgage income while also gaining exposure to the potential capital growth of commercial properties.

In 2024, with market conditions favoring well-managed property funds, investors are increasingly turning to these vehicles to enhance their portfolios. The ability to pool resources with other investors and access a diversified range of assets is particularly appealing in times of economic uncertainty.

For those seeking to diversify their investment portfolios, Australian property funds offer a compelling option. By blending mortgage and commercial property investments, these funds provide both stability and growth potential, making them a smart choice for a balanced investment strategy.